Eligible Vision Expenses with HSA & FSA: Full 2025 Guide

Are you sitting there with money in your HSA/FSA and wondering, Can I use it to have an eye exam, glasses, contact lenses, or even LASIK? You are not the only one. To sum up, the answer to this question is yes, You Can! Indeed, you may use both HSA and FSA funds to finance a great number of vision-related expenses.

I have supported hundreds of people like you to use their Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) to save money on eye care. Whether in the form of regular eye check-ups, prescription glasses, or refractive eye surgery, I have witnessed the effects of such benefits firsthand.

In this complete guide, I will take you through what, in fact, vision expenses are covered, how to properly utilize your benefits and some of the pitfalls you will not want to fall into.

What Are HSA and FSA Accounts?

HSA (Health Savings Account)

HSA is a tax-favored savings account with higher deductible health plans among high-income earners (HDHPs). The contributions you make to your HSA are rolled over year to year, and you can spend tax-free on eligible medical expenses such as vision care.

FSA (Flexible Spending Account)

FSA is also a tax-favored account provided by employers. You make contributions to the pre-tax dollars and utilize them during the plan year. As opposed to HSAs, the majority of plans covered by FSAs contain a “use it or lose it” policy, which means that timing counts.

Can You Use HSA and FSA for Vision Care?

Yes, You Can!

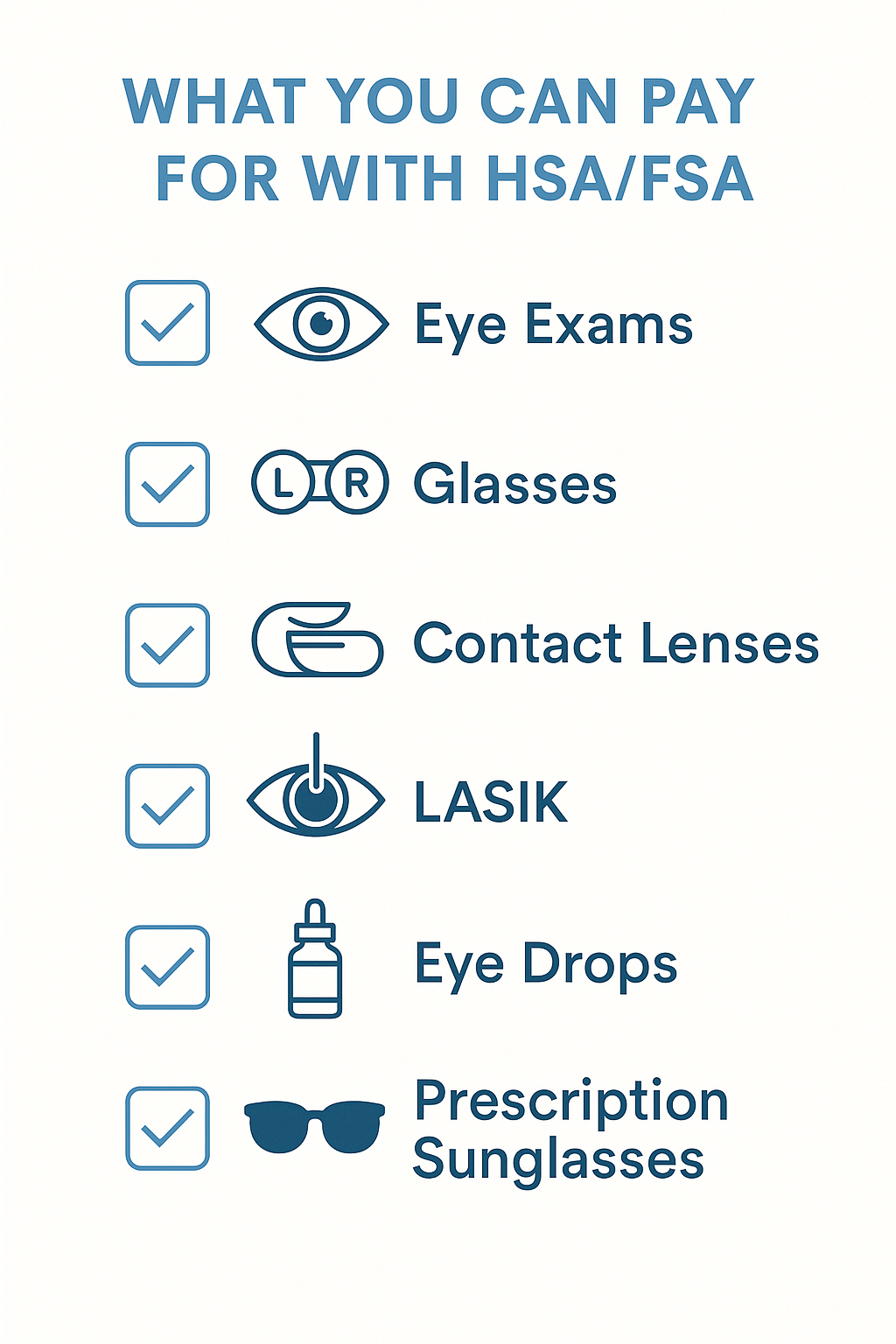

HSAs and FSAs can be used for many things, vision-wise. Both plans have expenses that are considered to be eligible according to IRS publication 502, as follows:

- Routine eye exams

- Prescription eyeglasses

- Prescription sunglasses

- Contact lenses and solution

- LASIK or other corrective eye surgeries

- Eye drops (if prescribed)

- Safety glasses with prescription lenses

I have worked as an eye specialist, and many of our patients manage to save hundreds of dollars every year by using their HSA and FSA to cover such services.

Can You Use HSA and FSA Together for Vision?

Yes, But With Some Rules

Technically, you can also have a combination of HSA and FSA, namely, a Limited Purpose FSA (LPFSA) permitting you to spend the funds on dental and vision costs. This combination could be extremely potent when supervised.

If you have both accounts:

- Use LPFSA funds first (since they usually expire)

- Use HSA funds as your long-term backup

This is always my advice to patients who require high vision care.

What Vision Expenses Are Covered by HSA and FSA?

Eye Exams

It can be a regular eye check to get your annual test, or you might struggle with the problem of blurred vision or sore eyes with a lack of moisture. In both HSA as well as FSA, your eye exam is completely covered. Make your appointment, and do not forget to check your vision.

Prescription Glasses

Yes, your regular glasses (prescription) are covered, along with the frames and lenses in them. You may even apply your benefits to extras such as anti-glare, scratch-resistant coating, or blue light types, provided they form part of your prescription.

Contact Lenses & Cleaning Solution

Every day, monthly, or toric lenses- are they are prescribed, they are covered. Your HSA or FSA may also be utilized with lens solution and lens storage packs that tend to keep your eyes safe and your contacts clean.

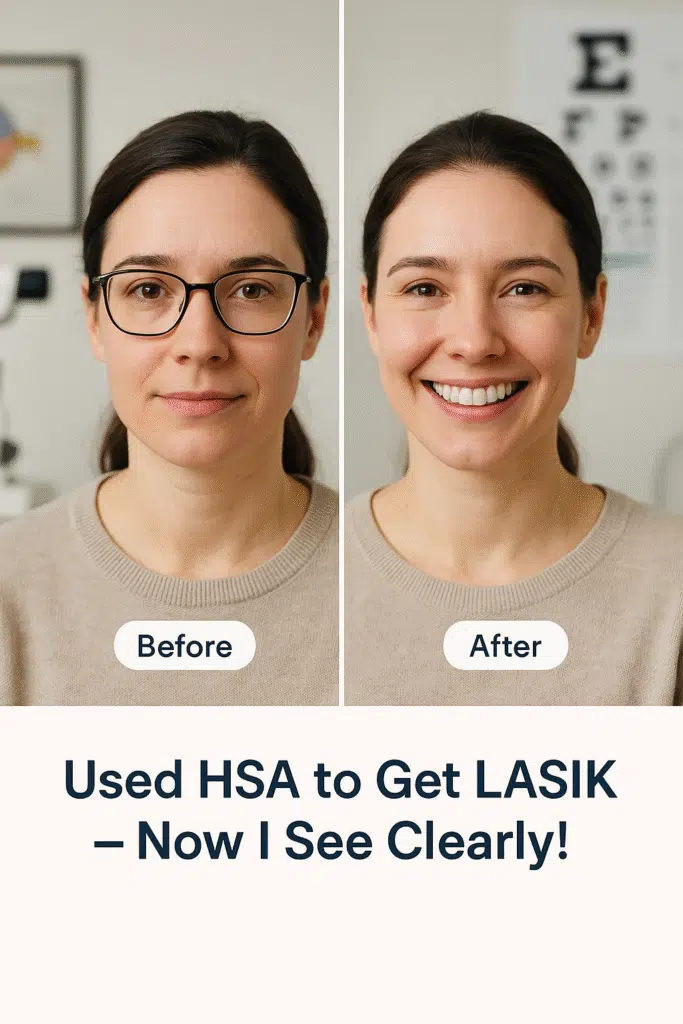

LASIK & Vision Correction Surgery

LASIK once and for all, in case you have been hesitating to do it due to the prices. I have seen a large number of patients use HSA or FSA to offset the cost of LASIK and other qualifying correction processes. All you have to do is to ensure that you are visiting a licensed provider.

Prescription Sunglasses

At last, you would have the sunglasses that you require that would help you save your eyes and enhance your eye power without having to spend money out of your pocket. When they arrive with a prescription, they are HSA/FSA eligible.

Prescribed Eye Drops & Medications

Repairing eye infections to allergy path, and chronic dry eye, you can get any drops and medications your eye doctor prescribes. Never put off treatment with your benefits at your disposal to enable you to lead a healthy, comfortable lifestyle.

Read Also: Shocking Thyroid Eye Disease Before & After Photos

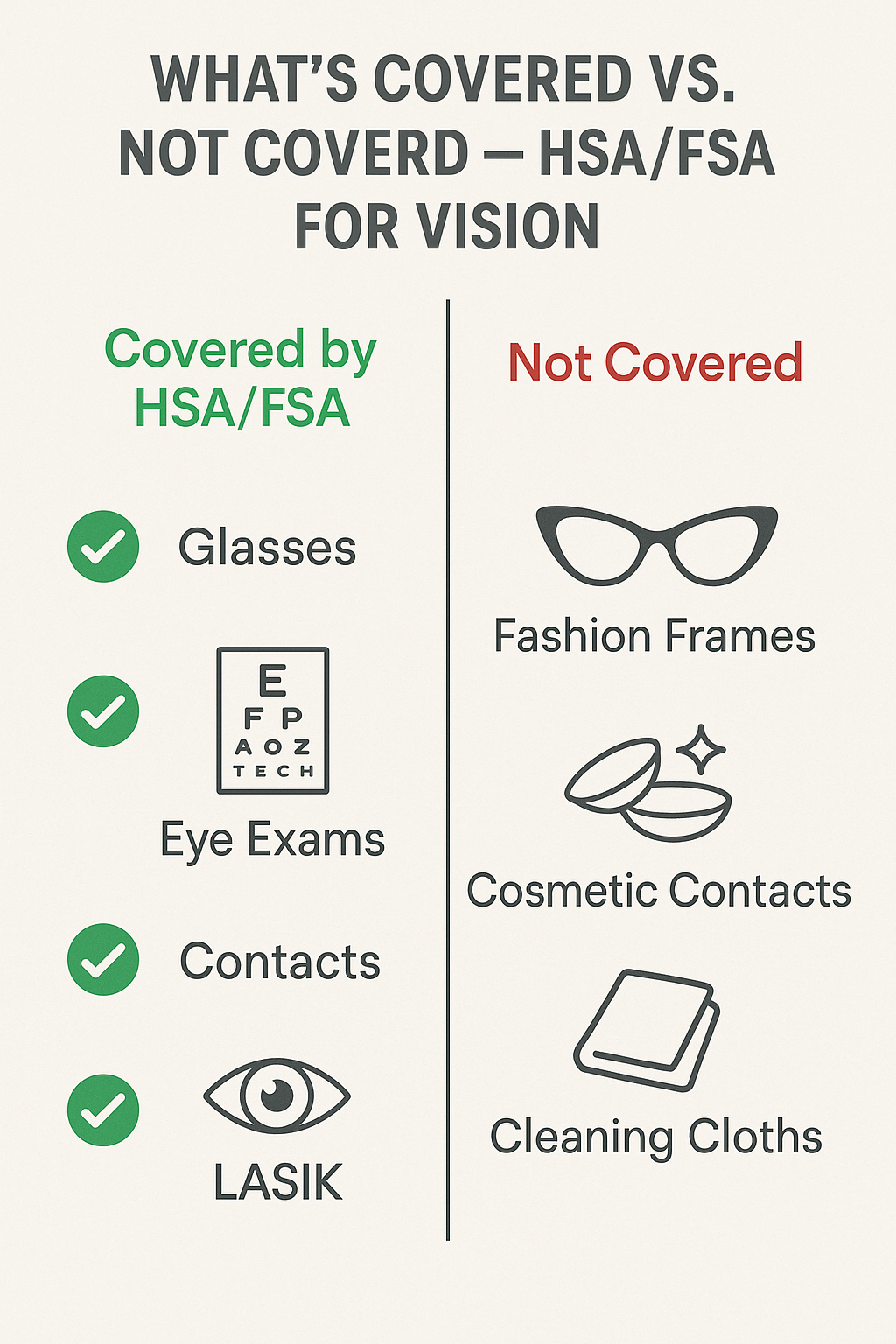

What Vision Expenses Are Not Eligible?

Now, I should like to dispel one great misunderstanding I am hearing all the time:

“Can I spend my HSA or FSA on those fancy glasses or coloured contacts (even when I do not require a prescription)?”

Short answer: No.

Just a short list of what your benefits will not cover:

Not Covered by HSA or FSA

- Non-prescription reading glasses

- Cosmetic or decorative contact lenses

- Designer glasses

- Accessories like cases, wipes, or lens cloths

Always check with your eye care provider (that would be me, of course, and I live locally) or with your HSA/FSA administrator if ever in doubt.

How to Pay for Vision With HSA or FSA

Use Your HSA or FSA Debit Card

The HSA/FSA debit cards are accepted at checkout at most eye clinics, optical shops, and retail shops online. A simple swipe and you are off!

Pay Out of Pocket and Get Reimbursed

Even in case your provider does not take HSA/FSA cards, do not worry. It is possible to pay in advance and claim reimbursement with proof of purchase in detail.

Always Save Your Receipts

If the IRS conducts an inquiry on your expenses, you must prove that your purchase qualified. And don’t lose those receipts.

FAQs

1. Can I use HSA or FSA for eye exams?

Yes! Both HSA and FSA cover routine eye check-ups. Only, in case it’s a long time, then the time to book it.

2. Are glasses covered by HSA or FSA?

Absolutely. Prescriptions (glasses+frames) can be used. The likes of anti-glare or blue light filters are also considered an add-on but can be prescribed.

3. Can I buy contacts with HSA or FSA?

Contact lenses and even contact lens solutions prescribed are covered, yes. It can be daily, weekly, or monthly; these are all valid.

4. Is LASIK eligible under HSA or FSA?

Yes. Any LASIK and similar surgeries may be funded using either of those accounts. The only thing is that you should visit an authorized provider.

5. What vision expenses are not eligible?

- Over-the-counter reading glasses (unless prescribed)

- Colored contacts without vision correction

- Designer glasses without a prescription

- Cleaning cloths or cases (unless bundled)

6. Can I use HSA and FSA together?

Yes, this is true, but only on the limited-purpose FSA. Spend the FSA money because it tends to run out faster.

Read Also: LASIK Eye Surgery Risks & Side Effects You Must Know

Final Thoughts

You should not keep the benefits of HSA or FSA just lying idle, and your vision care is one of the smartest ways to spend them. From eye check-ups to eyeglasses, contact lenses, and even LASIK, you are more covered than you imagined.

I have witnessed so many patients regret missing out on the benefits because they were unaware of what they could use, or they had already lost their FSA money due to failure to act in time.